Mexican real estate sponsors should lever their cultural know-how to address overlooked market opportunities in Texas. South San Antonio can serve as an example of the opportunities available to Latino GPs.

Mexican real estate general partners have an advantageous ability to develop and invest in Texas. Mexican appetite for real estate projects in Texas is growing as their Mexican investment partners push towards returns paired to the American dollar—aiming for acquisition power certainty. The Latino demand for quality rental housing in the State’s main cities is surging, as this group’s wealth, education, and population continue to rise. Specifically, a majority Latino population center, such as South San Antonio, presents a great opportunity for both established and novice Mexican general partners investing in the Texas real estate market.

Mexican companies and high-net-worth individuals have long been attracted to investing in the United States market as limited partners. These investments have become even more appealing over the last 5 years as the inherent risk of investing in Mexico has increased due to political concerns about the current populist federal administration. Consequently, Mexicans have sought to diversify their portfolios in larger international. High-net-worth individuals have benefited from visa programs such as the EB-5. These Mexican investors have pushed their domestic developer and financial sponsor partners to seek opportunities abroad. In response to their investment partners’ demands, various Mexican sponsors started cross-border operations, with Texas being one of their preferred locations due to its proximity and historical commercial partnerships with Mexico.

Multigenerational Latino communities have historically settled in Texas for more than 100 years. Those communities are very supportive within each other. The ones who were born in the State encourage their related family’s heads—commonly Latino mothers motivated by the education opportunities for their children—to move there, and even help them with generous financing while their settle. Now, the Latino presence in Texas has grown constantly for several years. According to the U.S. Census Bureau estimates, during the last 10 years, this population outpaced the population growth rate of all the other major ethnic groups combined in Texas1, now representing 38% of the total State population. Almost half of this population has settled in the Texas triangle’s main cities: Houston, San Antonio, Dallas, and Austin. The younger members of these families have benefited from those metros public-school systems, which are arguably better than those available at the Latino countries. Now, those better-educated individuals are substantially improving their family’s purchasing power on a “70% faster than that of Americans in general”2. This population now constitutes 65% (and growing) of the population of San Antonio, and still this market niche has been overlooked because, despite all these growth factors, their needs are widely misunderstood.

Real estate entry barriers in Texas are high—even more so for international players. The market is capital intensive and requires significant local expertise. Additionally, it is more difficult to deeply understand the local real estate market, as there is less reliable market data available than in other states, as Texas is a non-disclosure state—i.e. recurrently, foreign developers struggle to find an accurate set of sale/rent comps when underwriting new projects. Because of this, to successfully enter the market, Mexican sponsors must bring some added value. Mexican sponsors have an opportunity in Texas to leverage their Latino cultural expertise to better address the growing population’s virtues and preferences.

The Latino culture is very distinctive: the people cherish their traditions, enjoy being very close to family and friends, and are exceptionally hard workers—the main reason why so many of them every day are in search of better job and education opportunities. Those who cross to the border are mindful of their legally obtained migrant status and they take very good care of their creditworthiness, making them an ideal tenant. However, it takes deeper expertise to understand and anticipate the complex needs of this culture; Latinos want to preserve their living arrangements—i.e. living with more family members. Tim Shaughnessy, President of HPI Multifamily (HPITX.com) mentioned that the Latino market has some dissimilarities to other Texas markets including larger household sizes: “In most markets three-bedroom apartments take longer to lease-up and strongly follow the school calendar with leasing occurring predominantly over the summer months when children are out of school. In San Antonio, we’ve found these units easier to lease throughout the year.” He also shared that he’s seen an influx of capital from Latin American individuals and companies seeking investments in US real estate. According to Tim, the basis of their interest in US real estate investments varies; he’s seeing Mexican investors targeting Texas markets based on their familiarity with Texas while also seeing investors as far south as Chile looking to move capital into the US as a safe haven due to concern they have with political and economic pressures affecting their domestic investments. In both cases he’s seeing most investors prefer to keep their gains in US currency and either reinvest it or in the case of some individual investors setting it aside for vacations and shopping while in the US.

As the number of Latinos in Texas has dramatically increased, the number of apartments that actively target this market has increased too, but at a slower pace. Those sponsors who have identified and levered their knowledge of the Latino culture are enjoying large returns. They use their expertise to better provide for the Latino; but a big opportunity to satisfy Latino housing rent needs.

Eagle Property Capital (EPC), a real estate private equity firm is one real estate sponsor making the most out of the opportunity that the Latino population in Texas presents. The firm’s investment focus is on repositioning existing multifamily assets targeting predominantly, but not exclusively, Hispanic communities. The firm has acquired and managed ~$475 million in 26 multifamily properties (most of which are in Texas). The company attributes part of its investment success in this niche market to its understanding of catering to the Latino market’s needs.

According to Hector Gonzalez, VP of Operations & Asset Management at EPC, each of the firm’s fund acquires predominantly, but not exclusively, assets with underlying potential on the Hispanic/Latino community. Most of the staff is fluent in both Spanish and English, marketing is targeted within nearby areas of the community such as supermarkets and other gathering places, and the property management organizes recurring events to promote a sense of community for their residents. Additionally, some capital improvements are executed in the assets to improve the overall look and feel, i.e., apartments are renovated by opening kitchen areas and changing floors, unused spaces are repurposed as sports courts or barbeque areas, etc. Residents appreciate these changes, and through word-of-mouth, they spread the exceptionalism of living on an EPC property with their friends and family.

San Antonio is not only home to one of the densest Latino populations in the country, but it is also an affordable city showing rapid and continuous growth that is attracting a young Latino workforce. Because of its pro-business environment and because of those individuals hungry for job opportunities, San Antonio has proven to be resilient and robust. According to the Bureau of Labor Statistics, this market managed to maintain its GDP level in 2020 despite the COVID implications. Every year, work opportunities in this city maintain and attract more Latinos—mostly Mexicans, coming from northern cities such as Monterrey. The workforce of this community has long been actively present in the manufacturing, logistics, construction, and military service related industries3; now, the younger and better educated Mexicans are getting involved in more entrepreneurial activities in the city’s rising tech and health sectors. Among the various dense Latino submarkets in Texas, South San Antonio represents a great opportunity for Mexican multifamily real estate sponsors.

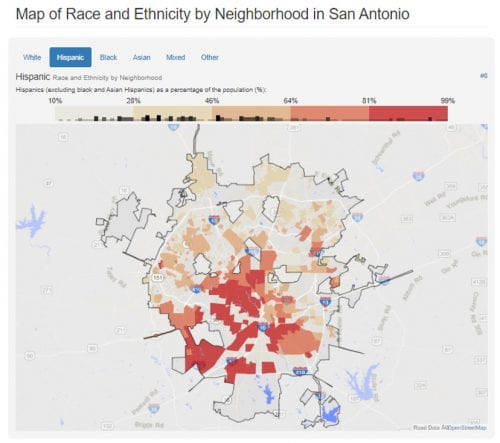

According to a study by the Southern Methodist University and the Migration Policy Institute, San Antonio has the youngest Mexican population nationwide4. Individuals from these communities tend to agglomerate and to live together in gated communities. Hispanics represent more than 99% of the ethnic population in some neighborhoods on the Southside of San Antonio. (see photo below).

The area has a well-established logistics and industrial sector—job drivers that are employing the Latino and Mexican populations. Additionally, the South submarket offers the new younger and well-educated Latino population quick access to the Central Business District, where, similarly to some of the other main cities of Texas, tech jobs are emerging. The chief economist of Zillow, Jeff Tucker, argues that, based on a market and demographic conditions analysis, San Antonio is more suitable for tech startup growth than Austin – one of the fastest tech growth cities in America. It is expected that the young Latino entrepreneurs and tech workers will benefit from this favorable environment.5

Despite all this growth in San Antonio, living conditions have remained affordable and it can be expected that the Latino population will continue growing—in terms of population, education level, and income. Therefore, the need for quality housing for the Latino workforce will become even more important. The South San Antonio submarket has all the necessary conditions for Mexican real estate sponsors to successfully invest in multifamily developments targeting the Latino population. Those sponsors must lever their cultural know-how and adapt potential developments or redevelopments to fit into the Latino community.

- https://www.texastribune.org/2020/06/25/texas-hispanic-population-grows-2-million/

- https://laprensatexas.com/latinos-contribution-to-the-us-economy/#:~:text=San%20Antonio%20is%20now%2065%25%20Latino%20and%20growing.&text=The%20LDC%20report%20found%20that,of%20%241.7%20trillion%20in%202020.

- https://www.americanimmigrationcouncil.org/research/immigrants-in-texas

- https://www.expressnews.com/news/news_columnists/elaine_ayala/article/Study-finds-Mexican-immigrants-in-San-Antonio-are-13842403.php

- https://sanantonio.culturemap.com/news/innovation/01-10-20-san-antonio-tops-austin-in-new-ranking-of-up-and-coming-tech-markets/

https://blog.realestate.cornell.edu/2021/05/20/drawing-upon-culture-opportunities-for-mexican-sponsors-in-san-antonio/